In the ever-evolving world of cryptocurrencies, staying updated with the latest market events is crucial for both investors and enthusiasts. The crypto industry, characterized by its volatility and rapid development, has experienced several significant events that have shaped its current landscape and could potentially forecast its future trajectory. Here’s a comprehensive look at the top 10 crypto market events that you shouldn’t miss.

Regulatory changes play a crucial role in the crypto market, often causing significant fluctuations in prices and influencing market sentiment. For instance, the recent legislative initiatives in the United States aimed at creating a clear regulatory framework for digital assets have been met with mixed reactions. By attempting to regulate digital currencies much like traditional financial assets, governments worldwide are aiming to protect consumers and prevent money laundering activities. However, these regulations can also stifle innovation and alter the dynamics of the decentralized nature of cryptocurrencies.

In 2023, the European Union’s MiCA (Markets in Crypto-Assets) regulation brought significant change to the market by implementing a comprehensive legal framework to govern digital assets across its member states. This move has provided much-needed clarity and confidence to both investors and companies operating within the EU, fostering a more secure and transparent ecosystem for digital assets.

Another noteworthy trend in the crypto space is the continuous developments in blockchain technology. New consensus algorithms, like Proof of Stake (PoS) and advancements in Layer 2 solutions, have improved scalability and energy efficiency, making crypto transactions faster and cheaper.

Ethereum’s major upgrade, Ethereum 2.0, marked a new era for the blockchain, significantly enhancing its scalability and energy consumption through the transition from Proof of Work (PoW) to PoS. This transformation is a game-changer for Ethereum and potentially serves as a model for other blockchains looking to transition to more sustainable and scalable networks.

Bitcoin, the most well-known cryptocurrency, continues to dominate the market and headlines with its unpredictable price swings. In 2023, Bitcoin experienced several dramatic price changes driven by various factors, including regulatory scrutiny and macroeconomic trends.

The introduction of Bitcoin ETFs (Exchange-Traded Funds) in several countries has been a highlight, providing institutional investors an easier way to gain exposure to Bitcoin. These financial products have brought more liquidity and legitimacy to the market, playing a significant role in attracting traditional investors to the crypto space.

The surge in interest around Non-Fungible Tokens (NFTs) has opened new dimensions for digital art and collectibles, attracting mainstream attention. Major brands and celebrities have jumped on the bandwagon, using NFTs as a novel way to engage their audience and generate revenue.

Beyond digital art, NFTs are finding applications in various sectors, including gaming, real estate, and music, showcasing the versatility and potential of blockchain in creating new digital economies.

The growth of Decentralized Finance (DeFi) has been nothing short of revolutionary, providing financial services without intermediaries. DeFi platforms have democratized access to financial instruments such as loans, savings, and insurance products, leveraging smart contracts to offer transparency and security.

However, the rise of DeFi has also brought challenges, such as security vulnerabilities and the need for careful navigation of regulatory landscapes.

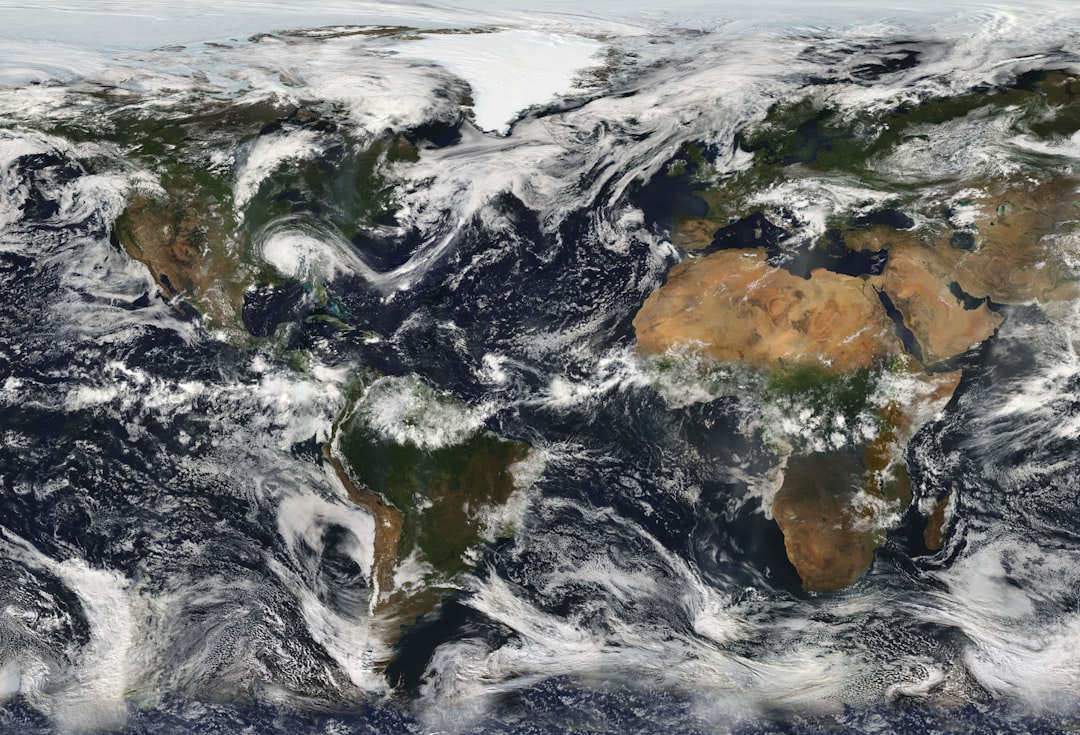

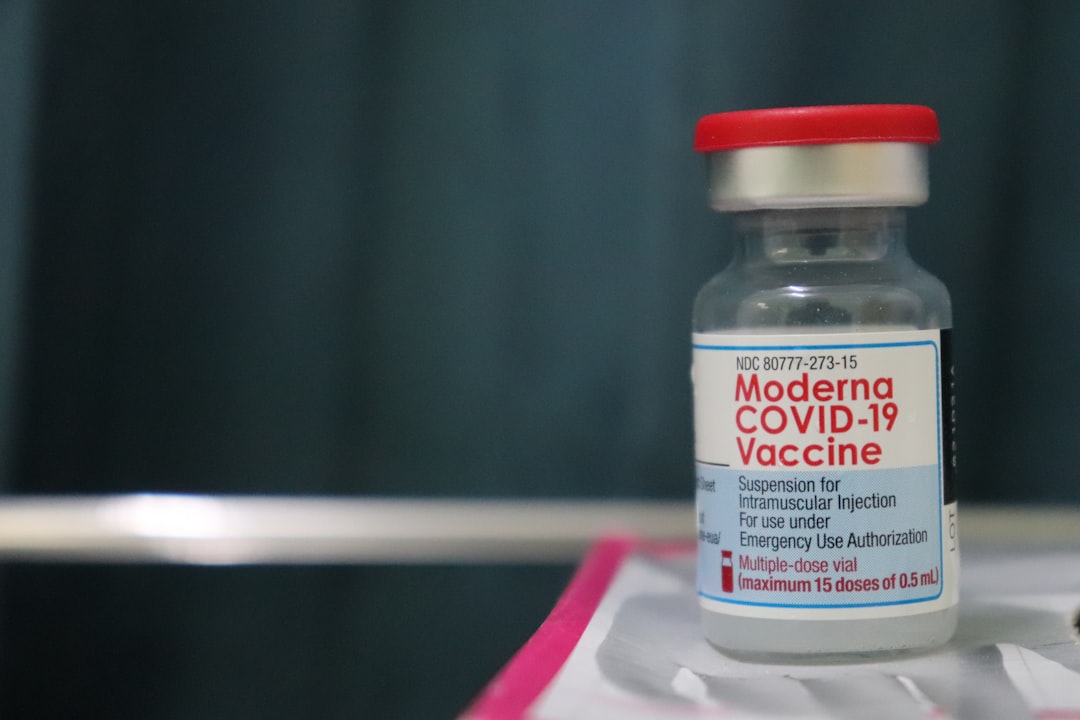

The interconnectedness of the global economy means that geopolitical tensions and macroeconomic factors significantly impact the crypto markets. Events such as the COVID-19 pandemic, trade wars, and inflation have contributed to the turbulent nature of crypto assets, with investors constantly seeking refuge in stablecoins during times of high volatility.

As the crypto market continues to mature, understanding and anticipating the influence of global events will be key for investors to manage risk effectively.

The crypto market is vivacious and rapid in its development, and keeping abreast of these pivotal events helps illuminate its path forward. As cryptocurrencies become an increasingly integral part of the global financial system, these notable events provide insights into the opportunities and challenges that lie ahead.

Insight Report

Top 10 Crypto Market Events

Leave a Reply